Is this article for you? It covers information for donors giving through Give Lively pages/forms.

Is this article for you? It covers information for individual/team fundraisers who collect donations on behalf of Give Lively member nonprofits.

Is this article for you? It addresses donating through Charity Navigator’s Giving Basket.

Is this article for you? It addresses donating through Charity Navigator’s Giving Basket.

Is this article for you? It covers information for nonprofits learning about Give Lively.

How do I find and understand my annual tax summary of donations?

To assist donors who file U.S. taxes, we provide easy and secure access to a full summary of the donations they made during that tax year to the nonprofit organizations that use our Give Lively fundraising platform. (IMPORTANT EMPHASIS: Nonprofits may offer multiple fundraising methods, but this tax summary ONLY includes those that were powered by Give Lively technology.)

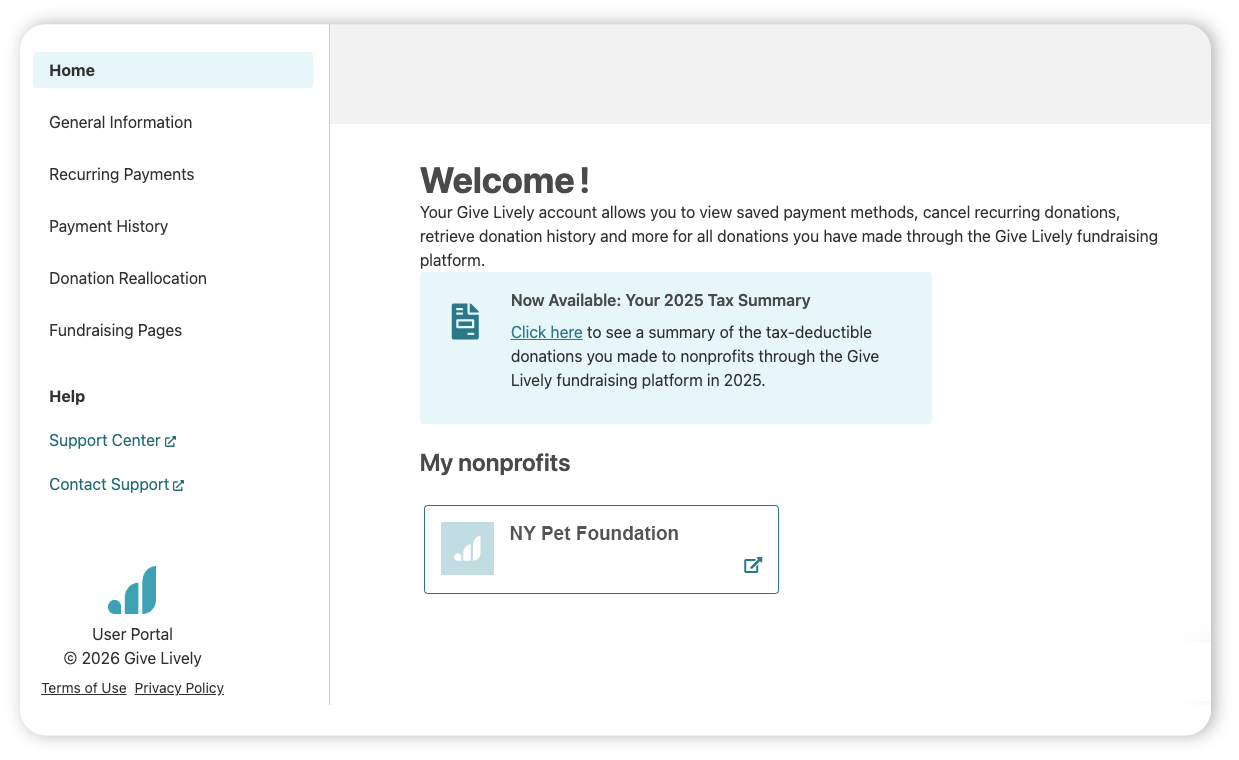

This annual donation summary is available at all times in our secure online Give Lively User Portal.

This article summarizes how to access the User Portal and make the most of your summary.

Log in to the User Portal

- If you already have your User Portal user account, then log in.

- If this is your first time using the User Portal, then you must create an account using the same email address submitted when donating. This must be a functioning email address and will need to be verified for the security of your account.

- If you donated using more than one email address, then you'll need an account for each email address.

Learn more about how to access the Give Lively User Portal and, if needed, set up a user account.

View and understand your annual tax summary

- To help you find your tax summary, we’ve placed two easy-to-see “Now Available: Your 2025 Tax Summary” call-outs (see above) within the secure User Portal. The first is on the main landing page after you log in; the second is at the top of the “Payment history” page.

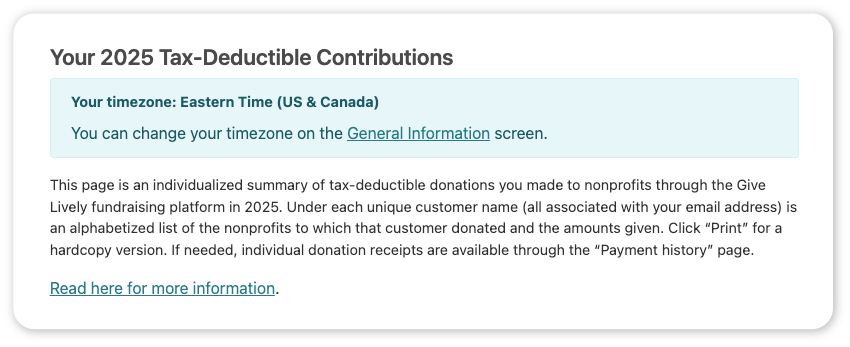

- Once on the “Your 2025 Tax-Deductible Contributions” page (see above), you will find an on-screen report with information organized as follows:

(a) Donations are grouped by each unique customer name associated with the email address. (For example, different family members may make donations using the same email address, but use their own names when they fill out the payment form. In the summary, each family member’s donations are grouped under each unique customer name.)

Two notes:

1 – With each unique customer name, there is a total tax-deductible dollar amount (as reported to us) donated by that customer.

2 – A unique customer name is made distinct by virtue of several factors, but NOT capitalizations or extra spaces. For example, if you used different spellings of your name, you will see each version of the name listed as a unique customer. The following are all unique customer names: Jonathan Smith, John Smith, John D. Smith, J. Smith and John Smith Jr. However, the following are not unique: John Smith, john smith and John Smith (extra spaces between names).

(b) Under each unique customer name is an alphabetized list of nonprofits to which that unique customer donated in the chosen tax year via Give Lively technology. Next to each nonprofit name is the total tax-deductible dollar amount (as reported to us) that each customer donated to that nonprofit.

Two notes:

1 – The donations associated with each nonprofit are ONLY those made via Give Lively fundraising technology. Other payments to other nonprofits or even to the same nonprofits using another company’s fundraising technology or made directly to the nonprofits will not appear in our summary.

2 – You may see the “Give Lively Foundation” (EIN: 81-0693451) as a beneficiary nonprofit, but you may not recognize the name. The Give Lively Foundation is a 501(c)(3) tax-exempt organization that collects charitable contributions and then re-grants them to other 501(c)(3) nonprofits across the United States. We use it to facilitate donation disbursement to nonprofits that are not Give Lively members but receive a donation through Charity Navigator's Giving Basket. These donations show up in the tax summary as contributions to the Give Lively Foundation, with a list of beneficiary nonprofit names underneath (without totals). “Give Lively Foundation” should be reported as the beneficiary for tax purposes.

- The default date and time range of the tax summary is UTC (learn about our use of UTC). Specifically, it covers 12 midnight, 01/01/[previous year] UTC to just before midnight, 01/01/[new year] UTC. You can “change your timezone” using the link at the top of the “Your 2025 Tax-Deductible Contributions” page to make your tax summary more accurate to your individual circumstance and ensure that all of your donations are included (learn more here). Note that this will only affect your tax summary; UTC will still be the default timezone elsewhere in the User Portal and used for the automatic email receipts.

- If you wish to save the tax summary, click the “Print” button to print it out or save it to your computer as a PDF file.

- If you need tax receipts for individual donations, whether just to review or to show an accountant/lawyer, look on the “Payment history” page in the User Portal. Every payment is listed, along with a tax receipt, and each receipt shows both the full payment amount and the reported tax-deductible amount. Some beneficiary nonprofits may also send a separate tax receipt, in which case you should feel free to use that. For nonprofits that do not send their own, the tax receipts Give Lively sent by email at the time of a donation or found through the Give Lively User Portal fully suffice for tax purposes.

NOTE: Any fully or partially refunded payments are noted in tax receipts in the User Portal and reflected in the tax summary totals.

- Have further questions?

(a) Reach out to the beneficiary nonprofit for concerns about the tax-deductible amounts. Our reporting of tax-deductible amounts is based on known amounts that are not tax deductible, such as the value of tickets purchased through an Event Ticketing page.

(b) Submit a support ticket to Give Lively for queries about other missing or mistaken payments.