How to turn the new tax laws into philanthropic wins

New tax rules took effect in the U.S. on January 1, 2026, and they changed how Americans will make charitable gifts, including how donations to nonprofits can be taken as tax deductions. Importantly for nonprofit leaders, these updates, all contained in the One Big Beautiful Bill Act (OBBBA), have more than just legal ramifications; they also present an opportunity to reassess donor outreach strategies and turn them into fundraising advantages.

For everyday donors: a big win

Most charitable donors give modestly. Starting in 2026, however, these "small but mighty" supporters have new ways to make the most of their generosity and may, as a result, choose to give more, if enabled.

Direct deduction for charitable donations

The OBBBA allows everyone who does not itemize deductions – meaning the 90% of tax filers who take the standard deduction – to deduct up to $1,000 (individual) or $2,000 (married couples filing jointly) directly from their income.

Importantly, this only applies to cash donations to qualified public charities, not stock or crypto gifts, not gifts to private foundations and not contributions to a donor-advised fund.

What this means for nonprofits

For years, small-gift donors have made charitable choices based on their belief in a cause or an organization. That isn't changing, but they will now also see a direct tax benefit from their philanthropy. With encouragement, these donors may be inspired to give more.

Nonprofit fundraising strategy to consider

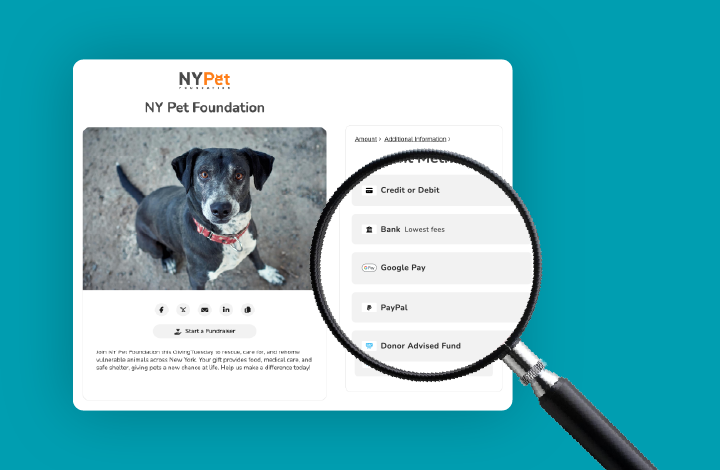

Add encouraging tax reminders to donor-facing materials – in emails, on fundraising pages, on "Ways to Give” pages. For example, consider the following, but always consult with a tax-law expert to confirm the language:

- For one-time donors: "Your cash gift is tax deductible.”

- For recurring donors: “The $80 cash donation you make every month is tax deductible.”

For major donors: new strategies needed

The OBBBA benefits for base-level fundraising are clearly positive, but the impact on major donors is more mixed. Supporters who itemize their deductions have new limits on refund eligibility.

0.5% eligibility floor

Much like an insurance deductible, tax benefits only kick in once charitable donations surpass 0.5% of a donor's adjusted gross income (AGI). For example, someone with an AGI of $500,000 is eligible for tax deductions on itemized gifts beyond an aggregated total of $2,500.

Unlike for non-itemizers taking the universal deduction, itemizers can claim gifts to private foundations, the fair market value of stock and crypto gifts and contributions to donor-advised funds.

35% benefit cap

For high earners in the top tax bracket of 37%, the tax savings on philanthropic gifts is now 35% (or 35 cents of every donated dollar). This means they get slightly less "cash back" on their gifts than previously. This is a small difference compared to the overall impact of the tax reduction.

60% AGI limit

This is now a permanent limit, capping cash gifts to public charities at 60% of AGI. This includes contributions to donor-advised funds. (Cash donations to private foundations are capped at 30%).

What this means for nonprofits

Major benefactors have new hoops to jump through. Depending on their income and the sizes of their gifts, new stewardship approaches may be required to secure ongoing support that maximizes tax benefits to the donor.

Nonprofit fundraising strategies to consider

Promote “bunching” or "multi-year pledges.” For example, instead of encouraging $5,000 donations every year for three years, suggest one $15,000 every three years.

Alternatively, encourage adoption of donor-advised funds, which are tax-advantaged giving accounts to which bulk donations can be made but from which grants are arranged in smaller amounts over as much time as desired.

These tactics help donors clear the 0.5% eligibility floor, maximize tax deductions and demonstrate sustained impact. Consider preparing financial wellness materials that frame the challenges and options for top benefactors.

For legacy and retired donors: in for the win

Older supporters with retirement accounts and donors of means with significant stock portfolios and/or large estates have new flexibility. Higher limits make it much easier for them to make major gifts and reap more significant tax advantages.

IRA advantages

After 70½ years of age, donors are allowed a Qualified Charitable Distribution (QCD), or tax-free transfer of funds directly from a traditional or Roth IRA to an eligible charity. The limit on QCDs has been increased to $111,000 for individuals and $222,000 for married couples filing jointly. It also isn’t constrained by an eligibility floor or benefit cap. Plus, a QCD counts toward Required Minimum Distributions without increasing taxable income.

Appreciated assets

Worth remembering: stock and crypto gifts still avoid capital gains taxes. When combined with tax deductions, they are a very efficient way to give.

Estate planning

Estate tax exemptions are now at an all-time high: $15 million for individuals and $30 million for married couples filing jointly. For very high net-worth people, extra tax-free inheritance may inspire additional giving.

What it means for nonprofits

Older supporters with means may see some windfall – or at least helpful tax advantages – from the OBBBA. Identify ways of tapping into it.

Nonprofit fundraising strategy to consider

When approaching wealthy donors, inform them of the tax benefits they may not be fully aware of and how, given advantageous tax laws, their funds may be stretched to support nonprofit causes.

Remember the $1,700 secret

Starting in 2027, a new tax law allows donors to take a tax credit (not a deduction) of up to $1,700 on educational scholarship gifts to eligible K-12 students, but only in participating states (states must opt in each year) and through identified Scholarship Granting Organizations (SGOs).

This is the first time a federal tax credit has been allowed for charitable giving. It is especially worth considering because tax credits amount to a dollar-for-dollar reduction in taxes – a direct savings. If a taxpayer owes $5,000 to the IRS, a $1,700 K-12 scholarship gift reduces that amount to $3,300.

What this means for nonprofits

For SGOs, this is a game-changer. The news should be front and center in all communications. A question worth asking donors: "Would you rather give $1,700 to the IRS or to deserving students?"

For other nonprofits, there is legitimate concern that the federal government’s decision to single out one type of charitable giving for a special tax benefit could chill donations to other causes.

Nonprofit fundraising strategies to consider

For SGOs, remind donors about the elevated value of a tax credit, versus a tax deduction. Research the participating states allowing for the tax benefit.

Non-educational nonprofits should partner with one!

For corporate donors: develop deeper partnerships

As it did for major donors, the OBBBA tax rules set new limits on corporate donors. In this case, there is a new floor beyond which tax benefits kick in.

1% benefit rule

Companies must now make corporate contributions of at least 1% of taxable income to claim any tax deduction. The existing 10% ceiling – the maximum deduction – remains in place, though a new rule allows any excess beyond the 10% to be carried forward for up to five years.

What this means for nonprofits

To begin with, there is concern that corporate giving may ebb a bit, as companies unable to reach the 1% floor choose not to give at all. Related to this, smaller, scattered corporate donations may be less beneficial to companies pushing to meet the lower limit.

Nonprofit fundraising strategies to consider

Pivot away from transactional requests for limited, one-time corporate sponsorship and focus on longer-term strategic partnerships. For example, rather than asking for a $5,000 “bronze” sponsorship, push to build a farther-reaching $25,000 “platinum” or “signature” multi-year program. Make note of the tax implications and express interest in working with the company to reach their tax thresholds in a meaningful way.

Conclusion

Donors give because they believe in a mission, but they stay because nonprofits make giving smart. Whether a nonprofit is helping small donors leverage the new universal deduction, guiding major benefactors through bunching strategies or building signature corporate partnerships, nonprofit leaders should adjust their positioning from asking to advising. By simplifying OBBBA complexities, they empower every supporter to maximize impact while securing an organization’s financial future.

.svg)

.svg)

.svg)

.svg)