Understand the third-party fees on donations through Give Lively

Everything you need to know about the fees and payment methods associated with use of Give Lively technology. We don't charge you anything, but third-party processors do.

Before you get started

Video Overview

Walkthrough

Before you get started

Video Overview

Walkthrough

Before you get started

Video Overview

Walkthrough

Before You Get Started

Video Overview

Walkthrough

We don't charge for the unlimited use of our powerful and practical technology. However, we use independent services to securely manage the financial transaction process, from donation to disbursement. These services do charge small fees, although the fees can sometimes be covered by the donor. (Learn more about disbursement and the data privacy and security practices put in place by us and these independent services.)

Which payment methods does Give Lively accept?

Give Lively fundraising technology currently accepts:

- all major credit cards and debit cards (Visa, Mastercard, American Express, Discover, Diners Club and JCB)

- ACH/bank transfer

- digital wallets like Apple Pay and Google Pay

- PayPal

- Venmo (new payment form only)

- DAFpay (new payment form only)

To process major credit cards and debit cards, we rely on Stripe and Shift4, two industry-leading payment processors trusted by thousands of companies and nonprofits. Credit and debit cards stored in Apple Pay or Google Pay are processed by Stripe.

Give Lively nonprofit members can add PayPal, but only as an optional additional donation-processing method. At the present time, it can't be the sole payment processor. All other payment methods (credit/debit, ACH etc.) are processed via Stripe or Shift4. In addition, when PayPal is integrated with our platform, Venmo will automatically appear as a payment method, but only to US-based donors using a supported device, only on our new payment form and never in donation widgets on Wix-hosted websites.

To manage ACH/direct debit, we work with Plaid and Stripe Financial Connections, two financial technology services that enable users to interact with their bank accounts. Both are trusted services that partner with thousands of US-based banks and guide users through a similar ACH/bank-payment process.

For donor-advised fund (DAF) grants, we use DAFpay, powered by Chariot, the leading DAF payments solutions provider. Learn more about DAFpay.

What are the fees associated with each payment method?

As described above, we partner with Stripe, Shift4, PayPal and Chariot (industry-leading payment providers) to manage donations. They charge a small transaction fee for each donation. There is a discounted base rate for qualified nonprofits that register with Stripe and PayPal, while Shift4 rates are automatically discounted.

Stripe, Shift4 and PayPal also charge fees for failed/disputed charges. Learn more about the charges associated with disputes.

As fees are subject to change at any time by the independent services, always verify directly with the services themselves for the latest updates.

Stripe fees

(as of December 2025)

Learn how to apply for the Stripe nonprofit discount. Stripe fees may be covered by the donor. Fee coverage legally increases the value of a donor’s contribution, so the gross value of the donation plus covered fees is necessarily reflected in a nonprofit’s fundraising totals.

That means, assuming nonprofits have applied for and received the Stripe nonprofit discount:

- Making donations via ACH/bank transfer is by far the most cost-effective payment option and ensures that you get more money to use toward your services.

- If domestic donors opt to use their credit cards: For all gifts under $23, you get more if your donors use American Express; for all gifts above $23, you'll get more if your donors use a Visa or MasterCard. This calculation is based on the nonprofit discounted rate for Stripe transaction fees (see above).

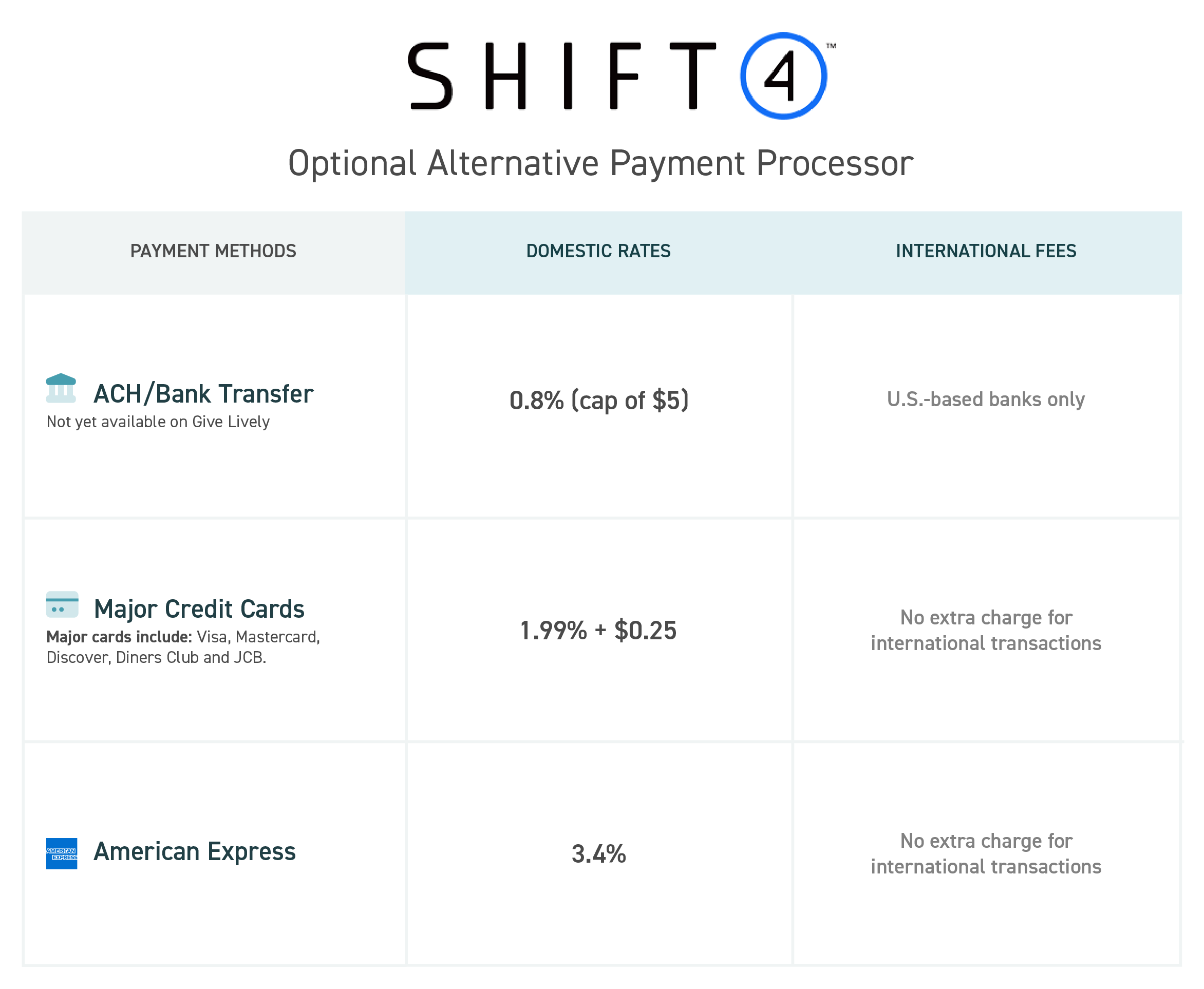

Shift4 fees

(as of December 2025)

Nonprofits interested in using Shift4 should contact Give Lively support. At present, the Shift4 integration on Give Lively is available for one-time card donations, with recurring donations and expanded payment methods to come. Until then, all other Give Lively payment methods remain available to donors, but are handled by Stripe or PayPal. Once the Shift4 integration has expanded to cover other donation frequencies and methods available through Stripe, nonprofits will be able to choose between Shift4 and Stripe for each type of payment method. PayPal will continue to be an optional additional payment processor for use alongside both Shift4 and Stripe. Learn more about Shift4 + Give Lively.

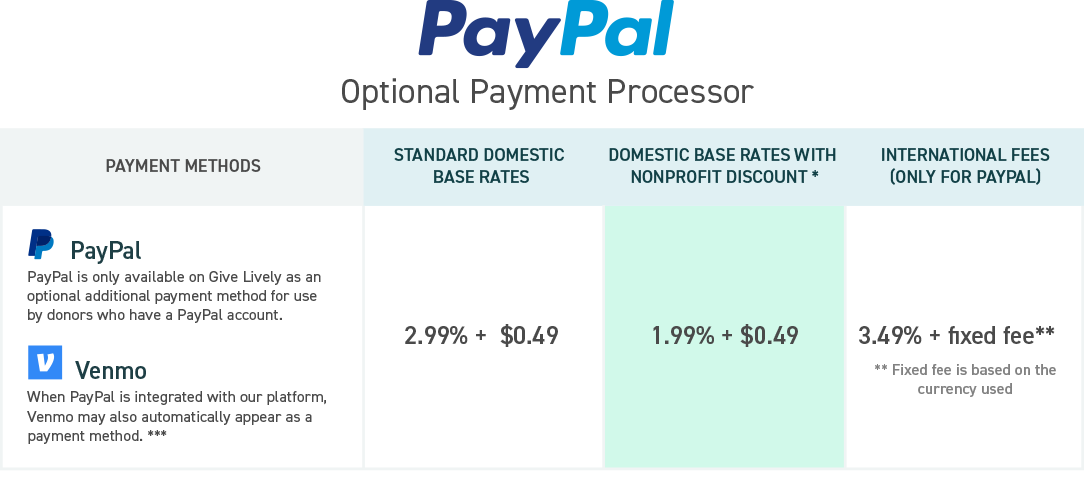

PayPal/Venmo fees

(as of December 2025)

* To enjoy special discounted transaction fees on payment through PayPal, a qualified organization must register an account with PayPal as a nonprofit and confirm its nonprofit status. This helpful PDF includes a checklist of what is needed to complete PayPal’s registration. Learn more about how to get confirmed charity status with PayPal.

** The fixed portion of the fee on international PayPal donations is based on the currency used. See PayPal's fixed fees for sending in other currencies.

*** When PayPal is integrated with our platform, Venmo will also automatically appear as a payment method, but only to US-based donors using a supported device, only on our new payment form and never in donation widgets on Wix-hosted websites

REMINDER: Give Lively nonprofit members can only add PayPal as an optional additional payment method. PayPal can't be the sole payment processor. All other payment methods (credit/debit, ACH etc.) are processed via Stripe. PayPal/Venmo transaction fees can be covered by the donor when using the new payment form, but not when using a first-generation payment form.

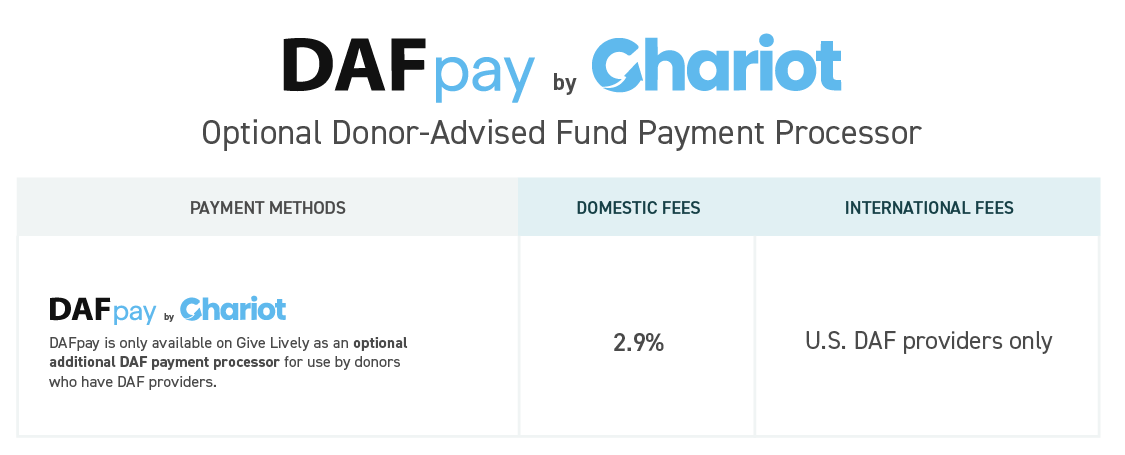

Chariot/DAFpay fees

(as of December 2025)

DAFpay by Chariot lets donors make a one-time charitable grant to nonprofits through their DAF providers. DAF grants must be in whole dollar amounts (no cents) so fee coverage is rounded up or down to the nearest whole dollar, except when the fee amount is less than $1, in which case it is always rounded up to $1. Learn more about DAFpay on Give Lively.

Does Give Lively charge any fees?

We don't charge any fees. The use of our platform is free for nonprofits and membership is both free and non-committal.

Give Lively was created by philanthropists to provide free fundraising technology to nonprofits. Our founders have worked extensively with charitable organizations and seen first-hand the positive impact innovative tech can have on fundraising. They started Give Lively in 2015 based on the belief that every nonprofit, no matter its size, should not sacrifice its means to satisfy its mission. So we collaborated directly with them to propel the development of our product -- a powerful, practical and free fundraising platform.

Our philanthropist founders cover the cost of running our business, which means we do not charge nonprofits for use of our technology. There are no setup fees, no monthly or annual fees, no commitments, and no hidden transaction fees beyond those described above and charged by our third-party partners.

Give Lively has also introduced the ability for donors to make a tip (not tax-deductible) to Give Lively and join forces with our founder-funders in supporting the nonprofit community. We call this donor-powered generosity “pay free forward.” A contribution is entirely voluntary and has no effect on the final donation amount the nonprofit receives. Learn more about tips to Give Lively.

Are donations to nonprofits made through Give Lively tax deductible?

Yes. Donations to nonprofits are tax-deductible to the full extent allowed by law. (Donors should always consult a tax professional to determine deductibility.)

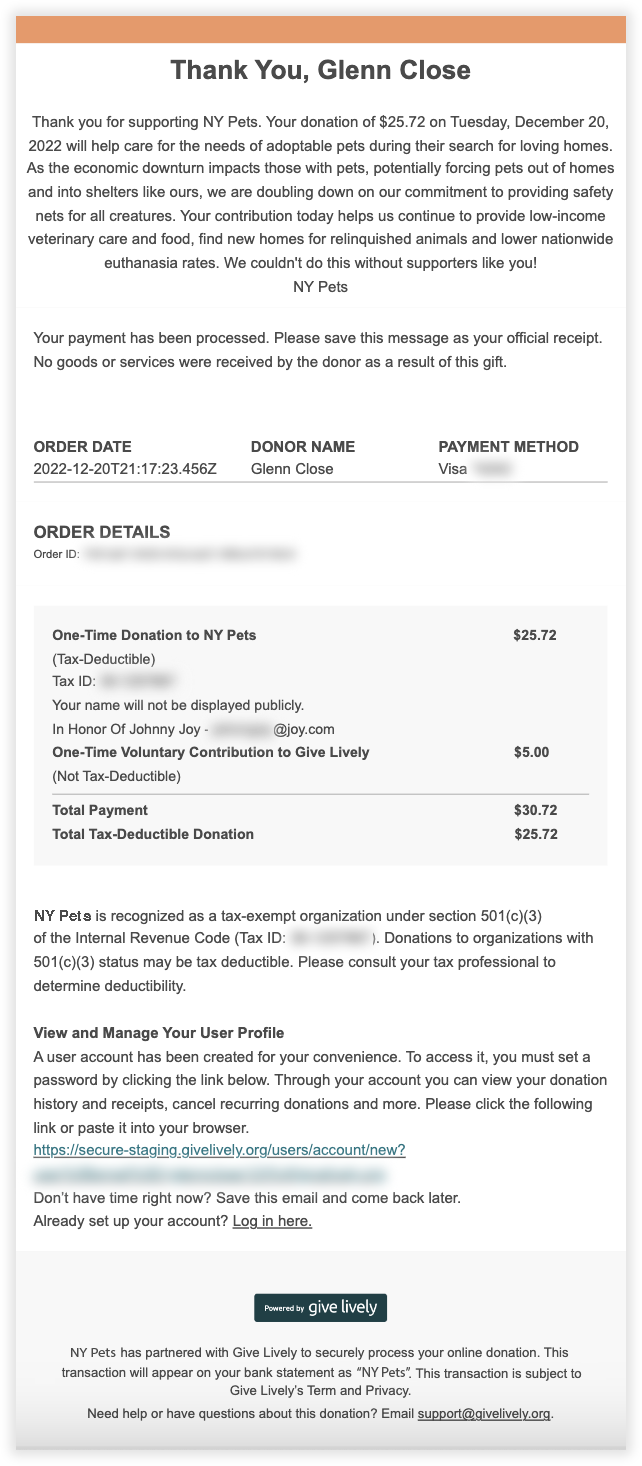

Immediately after donors complete their transactions via a nonprofit's Give Lively-powered fundraising page, they receive an email from hello@givelively.org containing a receipt for their donation that they can use for tax purposes.

All receipts include the following language:

"Your payment has been processed. Please save this message as your official receipt. No goods or services were received by the donor as a result of this gift."

ORDER DATE

DONOR NAME

PAYMENT METHOD

ORDER DETAILS

<Type of donation> to <Nonprofit Name> <amount>

Total Payment: <payment amount>

Total Tax-Deductible Donation <amount of the total payment that is tax-deductible>

<Nonprofit Name> is recognized as a tax-exempt organization under section 501(c)(3) of the Internal Revenue Code (Tax ID: <Tax ID>). Donations to organizations with 501(c)(3) status may be tax deductible. Please consult your tax professional to determine deductibility.”

Receipts for donations made through a new form will also include the following information:

“Order ID:” <#######>

“Campaign name”

“<Name of the fundraiser>,” if applicable

“One-Time Voluntary Contribution to Give Lively (Not tax-deductible) <amount>,” if applicable

“In honor of <name and email of the acknowledged>,” if applicable

“In memory of <name and email of the acknowledged>,” if applicable

“Your name will not be displayed publicly,”, if the donation was made anonymously

“Total payment <amount paid, both tax-deductible and not tax-deductible>”

Here's an example:

Note that this receipt also includes a link to a User Portal through which donors can directly and securely view their donation history and receipts, and manage recurring donations.

Thank-you messages/receipts are automatically sent to every donor. Nonprofits cannot opt out of this feature. At present, thank-you messages/receipts can only be reissued by Give Lively’s support team.